See what's clicking on FoxBusiness.com.

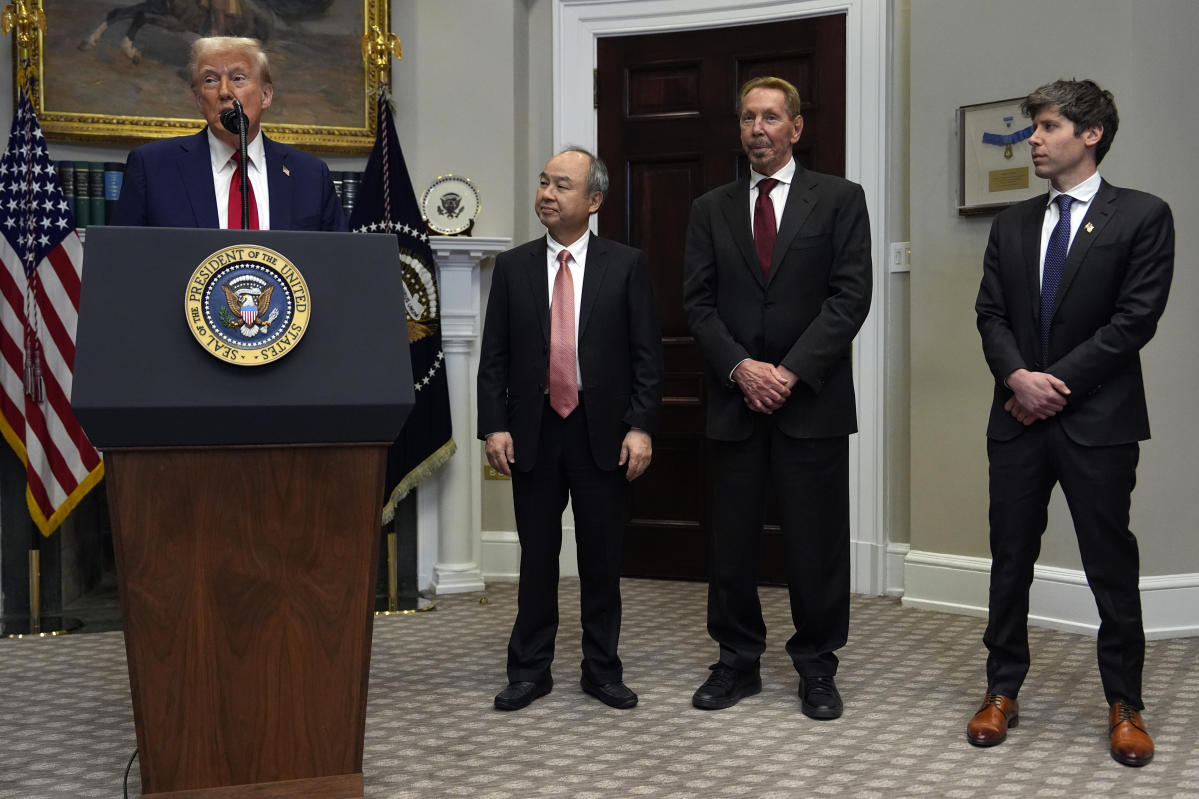

Former Speaker of the House Nancy PelosiD-Calif., announced several Inauguration Day stock trades that took place in December and early January involving several of the world's largest technology companies, an industry in which her husband, Paul, previously traded.

Congressional stock trading information, known as periodic transaction reports, includes trades made by both a member of Congress and a spouse.

Ian Krager, a spokesman for the former speaker, told FOX Business, “Speaker Pelosi owns no stock and has no prior knowledge or subsequent involvement in any transactions.”

NANCY PELOSI'S HUSBAND SOLD MORE THAN $500,000 IN VISAS BEFORE THE EVENT

Pelosi's disclosure showed the purchase of 50 call options for Alphabet, the parent company of Google, along with 50 call options for Amazon, according to its most recent periodic transaction report filed with the House Clerk.

Both sets of call options have a strike price of $150 and were valued between $250,001 and $500,000. Call options give investors the right to buy a company's stock at a certain price.

| Ticker | Security | Last | Conversion | Change % |

|---|---|---|---|---|

| AAPL | APPLE INC. | 222.64 | -7.34 |

-3.19% |

| NVDA | NVIDIA CORP. | 140.83 | +3.12 |

+2.27% |

| ALPHABET INC. | 198.05 | +2.05 |

+1.05% |

|

| AMZN | AMAZON.COM INC. | 230.71 | +4.77 |

+2.11% |

The disclosure showed the sale of 10,000 shares of Nvidia along with 31,600 shares of Apple on December 31. After the sale, Pelosi bought another 50 Nvidia call options on January 14, which had a strike price of $80 in a trade that was between $250,000 and $500,000. Pelosi also exercised 500 call options on Nvidia on December 20, which had a strike price of $12 and were set to expire that day.

This deal was between $500,000 and $1 million.

Former Speaker of the House Nancy Pelosi of California announced new stock deals involving major technology companies. (Chip Somodevilla/Getty Images/Getty Images)

The former speaker's disclosure also noted several other investments that occurred in the past month, including the exercise of 140 call options on 14,000 shares Palo Alto Networks at a strike price of $100 that was set to expire on December 20 in a deal that ranged between $1 million and $5 million.

Pelosi also disclosed a purchase of 50 Tempus AI call options with a strike price of $20, as well as 50 Vistra Corp. call options. with an exercise price of $50 on January 14th. Vistra's purchase was in the $500,000 to $1 million range, while Tempus was between $50,000 and $100,000.

| Ticker | Security | Last | Conversion | Change % |

|---|---|---|---|---|

| VST | VISTRA CORP | 185.35 | +14.49 |

+8.48% |

| TEM | YOU HAVE TIME | 47.64 | +12.49 |

+35.53% |

BIPARTIC GROUP OF SENATORS REACH AGREEMENT TO BAN LAWMAKERS FROM STOCK TRADING

Former Speaker of the House Nancy Pelosi and husband Paul Pelosi attend the Vanity Fair Oscars Party on March 10, 2024 at the Wallis Annenberg Center for the Performing Arts in Beverly Hills, California. (Michael Tran/AFP via Getty Images/Getty Images)

Pelosi's and her husband's investments have drawn attention amid growing calls for members of Congress to be banned from stock trading.

| Ticker | Security | Last | Conversion | Change % |

|---|---|---|---|---|

| AGAINST | VISA INC. | 323.63 | +4.01 |

+1.25% |

Last fall, Paul Pelosi sold more than $500,000 worth of Visa stock ahead of a Justice Department antitrust case against the credit card giant. Early last year, an analysis estimated the pair earned nearly $4 million over a six-month period Nvidia call options bought in November 2023.

Lawmakers' spouses can do business in companies or industries that their partner can help regulate, but it's illegal members of Congress and their family members to profit from inside information.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Members of Congress on both sides of the political aisle have proposed legislation in recent years that would bar lawmakers and their family members from owning the stock. Bipartisan bills to that effect were drafted in the Senate during the last Congress, but none became law before the end of the 118th Congress, leaving the matter to the current Congress.

Breck Dumas of FOX Business contributed to this report.