Business correspondent, BBC News

US President Donald Trump imposed a set of definitions – or import taxes – on billions of dollars from goods coming to the United States from some of its commercial partners.

Definitions apply to steel and aluminum imported to the United States, as well as to some other products from Mexico, Canada and China – which leads to counter -measures from the last two countries and the European Union.

Economists have warned the American definitions – and those who have been in response to other countries – could put prices for American consumers.

This is because the tax is paid by the local company that imports goods, which may choose to transfer the cost to customers, or to reduce imports, which means that the products are less.

So what things can become more expensive?

Cars

Some cars are among the products that Trump temporarily granted from a 25 % new import tax imposed on Canada and Mexico.

When this ends, the price is expected to rise – about $ 3000 (2,300 pounds) according to TD ECONOMics.

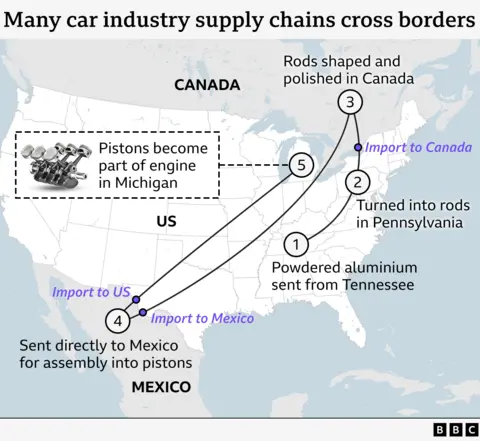

This is because parts cross the United States, the Canadian and Mexican borders several times before assembling the car.

Many of the well -known brands of cars, including Audi, BMW, Ford, General Motors, Honda Trade Parts and Oper in the three countries.

The cost of the high taxes due to imported components to customers will be transferred.

Andrew Furan said: “It is sufficient to say that disrupting these trends through the definitions … will come at great costs,” Andrew Furan said.

He said that “uninterrupted free trade”, which “existed for decades” in the automotive sector has reduced consumer prices.

Al -Bireh, Al -Naski and Tikila

Gety pictures

Gety picturesThe famous Beers Modelo and Corona can become more expensive for customers in the United States if American companies imported are transporting increasing import taxes.

However, it is also possible for companies to decide to bring a lower foreign beer.

Modelo became the first brand of beer in the United States in 2023, and remains at the forefront.

The image is more complicated when it comes to spirits, which have been largely free of customs tariffs since the 1990s.

Industry bodies from the United States, Canada and Mexico issued a joint statement before announcing the customs tariff that it says is “very concerned.”

They argue that some brands, such as Bourbon, Tennessi whiskey, Tickilla and Canadian whiskey “are recognized as distinctive products and can only be produced in their designated countries.”

So due to the production of these drinks it cannot be transferred simply, supplies may be affected, which leads to high prices.

The bodies also highlighted that many companies have different brands of the soul in the United States, Canada and Mexico.

Homes

The United States imports about a third of the wooden wood from Canada every year, and these main building materials can be exposed with a Trump tariff.

Trump said the United States has “more wood than we use.”

However, the National Association of Home Buildings urged the main to exempt building materials “because of its harmful impact on the ability to afford housing.”

The industry group “serious fears” has that the customs tariff for wood can increase the cost of building houses – which are mostly wood in the United States – as well as delaying developers who build new homes.

NAHB said: “Consumers end up paying customs duties in the form of high prices of homes,” NAHB said.

Imports from the rest of the world can also be affected.

On March 1, Trump ordered an investigation of whether the United States should put an additional tariff on most wood and wood imports, regardless of their country of origin, or create incentives to enhance local production.

Results due to the end of 2025.

maple syrup

Gety pictures

Gety picturesThe family influence will be the “most obvious” commercial war with Canada on the price of Canadian maple syrup, according to Thomas Sampson of London Economics College.

The Canadian industry accounts for $ 75 % of the production of the entire maple syrup in the world.

The majority of the sweet primary element – about 90 % – is produced in Quebec Province, where the only strategic reserves in the world have been created for maple drink 24 years ago.

“The maple syrup will be more expensive. This is a direct increase in prices that families will face,” said Mr. Sampson.

“If you purchase the goods that are produced locally in the United States, but (that uses) inputs from Canada, the price of these goods will also rise,” he added.

Fuel prices

Canada is the largest foreign resource in America of crude oil.

According to the latest official trade numbers, 61 % of imported oil came to the United States between January and November 2024 from Canada.

While the United States provided a 25 % tariff for most imported goods from Canada, Canadian energy faces a 10 % less than 10 %.

The United States does not suffer from oil shortages, but its refineries are designed to treat the so -called “heavier” – or more thick oil, which often comes from Canada, with some Mexico.

“Many refineries need heavier raw oil to increase the elasticity of gasoline, diesel and jet fuel production,” according to American fuel and petrochemical manufacturers.

This means that if Canada decides to reduce crude oil exports in revenge on the American tariff, this may increase fuel prices.

Avocado

Gety pictures

Gety picturesAvocado flourishes in the Mexican climate.

almost 90 % of avocado consumed in the United States come from Mexico.

The US Department of Agriculture has warned that the customs tariff for Mexican fruits and vegetables could increase the cost of avocado.

Related dishes like Guacamole can also become more expensive.

Additional reports by Lucy Atcheson