Charles Schwab Corp (NYSE: Schw) resists with others Main bank sharesBecause the financial sector weighs economic uncertainty and persistent sales pressure. With Wall Street on the edge above the negotiations on tariff and concerns about the recession, traders follow the banking supplies for potential value opportunities in the middle of volatility.

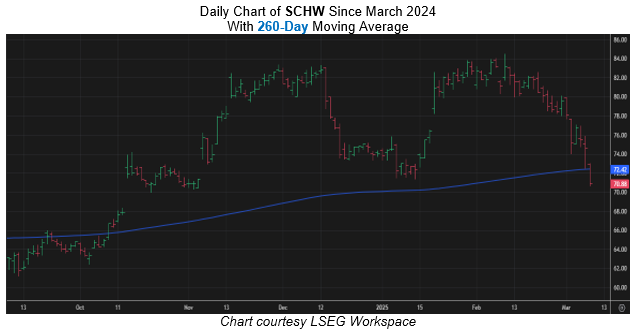

On charts, Stock Charles Schwab He deleted his profit by 11.8% January and now a year -on -year decrease of 4.1%, on the way to 11. Loss in 13 sessions. Last time he saw 4.9% lower to $ 70.95, stocks are at a striking distance from 260 -day gliding diameter, which is historically a bull level.

According to Schaeffer's higher quantitative analyst Rocky White Schw, he tested this trend line five times in the last three years, and each time the shares were higher a month later with an average profit of 8.4%. A similar reflection from current levels would place its own capital just below $ 77 and approached its 11th February, a 13 -month maximum of $ 84.50.

The unfolding of the bear sentiment in the possibilities could provide other tail winds. In the 90's percentage percentage of last year, in the 90s of the International Stock Exchange (ISE), CBE Options Exchange (CBOE) and NASDAQ OMX PHLX (PHLX) in the 90th Percentile Percentile on the International Stock Exchange (ISE) and NASDAQ OMX PHLX (PHLX).

Plus Schw's Scaeffer's Volatility Scorecard (SVS) From 91 out of 100 suggests that shares tend to overcome the expectations of volatility, making it an attractive setting for the buyer of the premium.